In the intricate financial landscape of the United States, a robust credit score is more than just a number—it’s a passport to financial flexibility and opportunity. Whether you’re aiming for a mortgage with favorable terms, eyeing the latest auto loan rates, or seeking the most rewarding credit cards, a good credit score can open doors to a plethora of financial benefits. Below, we delve into the strategies and habits that can help you build and maintain an impressive credit profile.

Understanding Your Credit Score

Before you can improve your credit score, it’s essential to understand what it is and how it’s calculated. In the USA, credit scores range from 300 to 850, with higher scores reflecting better creditworthiness. The most widely used credit scores are FICO scores, which are calculated based on your credit history data from the three major credit bureaus: Equifax, Experian, and TransUnion. The key factors influencing your credit score include payment history, amounts owed, length of credit history, new credit, and types of credit used.

Strategies for Building Good Credit

Pay Your Bills on Time: Your payment history is the single most significant factor affecting your credit score. Set up reminders or automate payments to ensure you never miss a due date.

Maintain Low Credit Card Balances: The ratio of your credit card balance to your credit limit, known as your credit utilization ratio, should ideally be below 30%. This demonstrates to lenders that you’re not overly reliant on credit.

Diversify Your Credit Portfolio: A mix of different types of credit accounts, including credit cards, retail accounts, installment loans, and mortgage loans, can positively affect your score.

Limit New Credit Applications: Each time you apply for credit, a hard inquiry is made, which can temporarily lower your score. Apply for new credit sparingly and only when necessary.

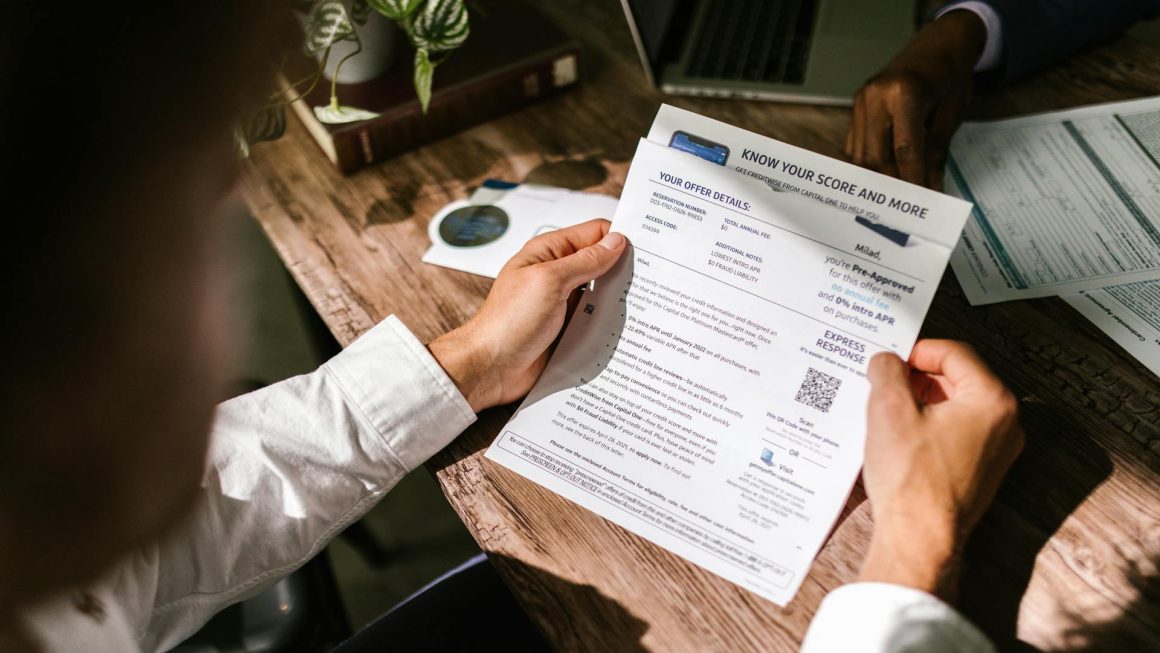

Regularly Monitor Your Credit: Keeping an eye on your credit report can help you catch and dispute any inaccuracies or fraudulent activities early on. You’re entitled to a free credit report from each of the three major credit bureaus once every 12 months through AnnualCreditReport.com.

Be Patient and Consistent: Building or improving a credit score is a marathon, not a sprint. Consistent, responsible credit behavior over time is key.

Navigating Challenges

Improving your credit score can be particularly challenging if you’re starting with a low score or have no credit history at all. Consider starting with a secured credit card, which requires a cash deposit that serves as your credit line. This can be a safe way to build credit, as the deposit minimizes the risk for the issuer. Alternatively, becoming an authorized user on a family member’s credit card can help you piggyback off their good credit habits, provided they use credit responsibly.

Conclusion

In today’s financial ecosystem, a good credit score is invaluable. It not only affects your ability to borrow money but can also influence insurance rates, rental applications, and even job prospects. By understanding how credit scores work and adopting disciplined financial habits, you can build a strong credit profile that will serve you well throughout your financial journey in the USA. Remember, the path to excellent credit is built on timely payments, low credit utilization, and smart credit management. Start today, and watch your financial opportunities expand.