A credit rating is a critical assessment tool, providing a quantified evaluation of an individual’s or entity’s creditworthiness. Essentially, it represents the likelihood that the borrower will meet their financial obligations as agreed. Credit ratings are pivotal for individuals, businesses, and governments, influencing their ability to borrow money, the terms of borrowing, and the interest rates they will pay.

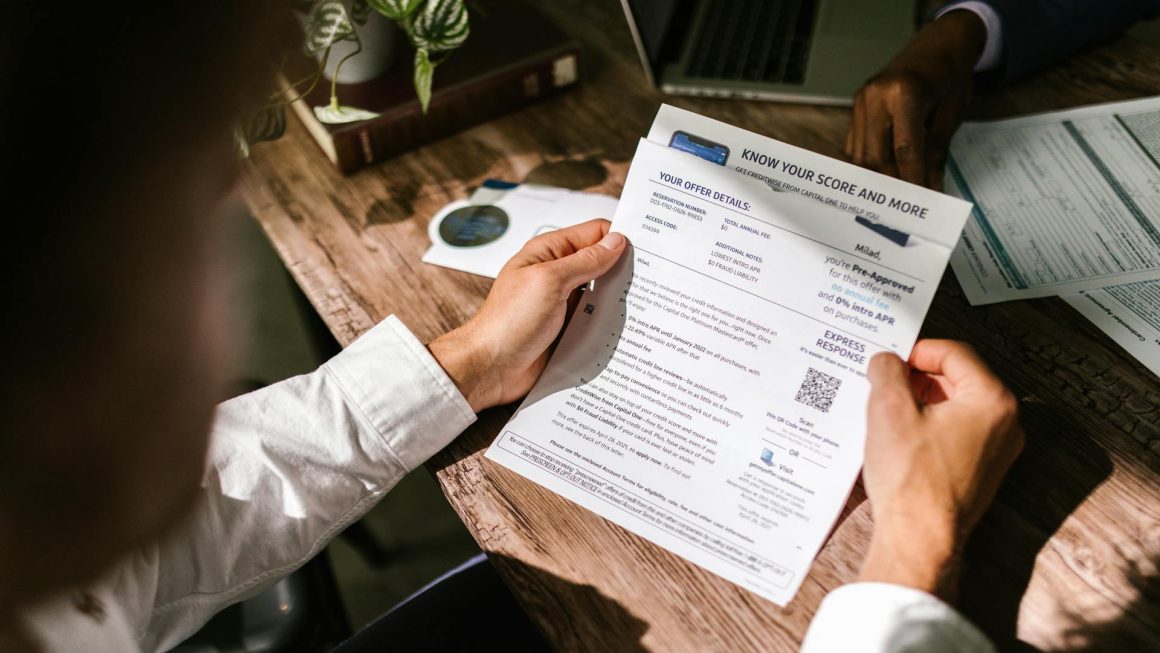

For individuals, credit ratings are determined based on credit history, including factors like payment history, the total level of debt, length of credit history, types of credit used, and recent credit inquiries. Credit bureaus such as Equifax, Experian, and TransUnion compile this information to generate credit scores, which lenders use to make decisions on loan approvals and interest rates.

In the corporate world, credit ratings assess a company’s financial strength and its capability to repay its debt. These ratings are provided by credit rating agencies such as Standard & Poor’s, Moody’s, and Fitch. They consider factors like the company’s revenue streams, debt levels, market position, and economic conditions. A high credit rating suggests a strong ability to meet financial commitments, attracting investors and lowering borrowing costs.

Similarly, governments are assessed to determine their ability to repay sovereign debt. A country’s economic environment, fiscal health, and political stability are critical factors influencing its credit rating. Sovereign credit ratings impact a country’s ability to attract foreign investment and can significantly affect its economy.

Credit ratings, whether for individuals, corporations, or countries, play a vital role in the global financial ecosystem. They influence borrowing costs, investment decisions, and economic stability. As dynamic indicators, they require continuous monitoring and understanding, underlining their significance in financial planning and economic strategy.