In the financial world, credit is a fundamental concept that influences countless decisions made by individuals, businesses, and governments. At its core, credit is the trust that allows one party to provide resources to another party wherein the second party does not reimburse the first party immediately but promises either to repay or return those resources at a later date. This mechanism not only fuels economic growth by facilitating transactions that would otherwise be delayed or impossible but also plays a critical role in personal financial management.

Credit comes in various forms, including loans, credit cards, mortgages, and lines of credit. Each type serves different purposes and comes with its own set of terms and conditions. For individuals, credit can mean the difference between owning a home or starting a business and waiting years to save enough money to do so. However, access to credit also requires responsibility. Proper management of credit involves understanding interest rates, repayment terms, and the impact of credit on one’s financial health.

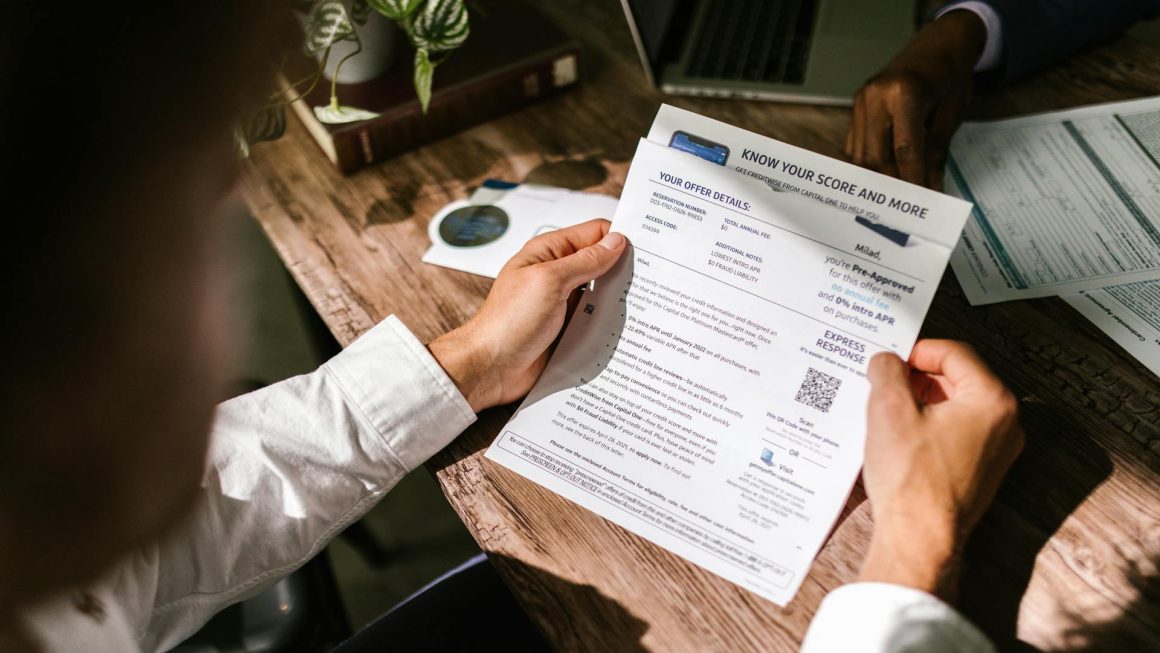

One of the most significant aspects of credit is the credit score, a numerical representation of a person’s creditworthiness. Lenders use credit scores to determine the likelihood that an individual will repay borrowed money. A high credit score can lead to better interest rates and terms on loans and credit cards, while a low score can limit access to credit or make borrowing more expensive.

The importance of maintaining a good credit history cannot be overstated. This involves making payments on time, keeping credit card balances low, and avoiding excessive borrowing. Education on credit management is crucial for financial stability and growth, as it empowers individuals to make informed decisions about borrowing, saving, and investing.

In conclusion, credit is a powerful tool that, when used wisely, can open doors to financial opportunities and security. Understanding the intricacies of credit and maintaining a solid credit history are essential steps toward achieving personal financial goals and contributing to economic prosperity.