Building good credit is a fundamental step toward financial health and independence. It opens doors to lower interest rates, better financial products, and opportunities that wouldn’t be available otherwise, such as renting an apartment or buying a home.

1. Understand Your Credit Report and Score

AnnualCreditReport.com

The first step to building good credit is understanding where you stand. AnnualCreditReport.com is the only federally authorized website for free credit reports. You can request a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once every 12 months.

Credit Karma, Credit Sesame

These are free services that provide credit scores, reports, and monitoring. While they don’t offer official FICO scores, they’re useful for tracking your credit status and understanding the factors affecting your score.

2. Credit Counseling Services

National Foundation for Credit Counseling (NFCC)

The NFCC offers access to nonprofit credit counseling. Counselors can provide guidance on budgeting, credit building, and debt management plans to help you improve your financial situation.

Consumer Credit Counseling Services (CCCS)

CCCS agencies, found nationwide, offer free or low-cost advice on credit improvement and debt management. They can also negotiate with creditors on your behalf to lower interest rates and establish repayment plans.

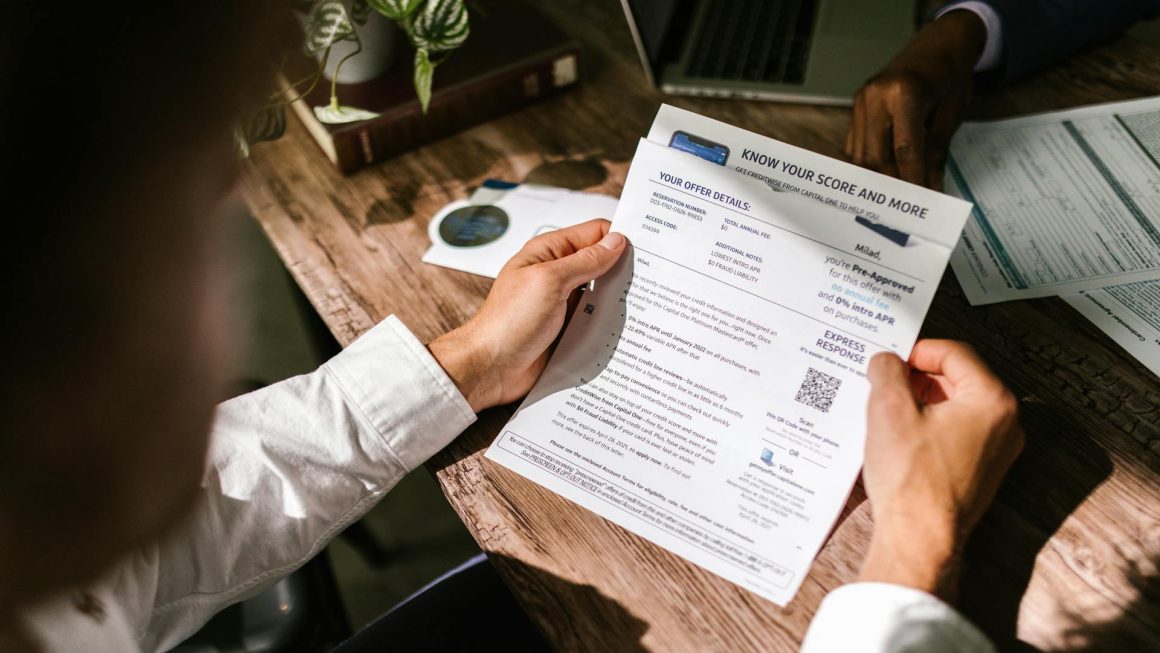

3. Secured Credit Cards and Credit Builder Loans

Secured Credit Cards

These require a deposit that serves as your credit limit. They’re an excellent way to start building credit if you’re new to credit or looking to rebuild. Major banks and credit unions offer secured cards.

Credit Builder Loans

Available from credit unions and some banks, these loans hold the borrowed amount in a bank account while you make payments, building credit in the process. Upon completion, you get access to the loan amount.

4. Financial Education Resources

MyMoney.gov

This website offers a wealth of information on making informed financial decisions, including understanding credit and how to improve it.

Consumer Financial Protection Bureau (CFPB)

The CFPB provides educational materials on credit and how to manage it. They offer tools and resources for disputing errors on your credit report and advice on dealing with debt.

5. Use Technology to Your Advantage

Budgeting Apps

Apps like Mint, YNAB (You Need A Budget), and PocketGuard can help you manage your finances, ensuring you pay your bills on time and maintain a budget — both crucial for building good credit.

Credit Monitoring Services

Services from Experian, TransUnion, and Equifax offer credit monitoring for a fee. They provide alerts for any significant changes to your credit report, helping you catch and resolve issues quickly.

6. Professional Financial Advisors

Certified Financial Planners (CFP)

For personalized advice, consider consulting a CFP. They can offer strategies tailored to your financial situation to help you build credit and achieve other financial goals.

Conclusion

Building good credit doesn’t happen overnight. It requires discipline, patience, and a commitment to financial responsibility. By utilizing the resources and strategies outlined above, you can set yourself on a path toward a strong credit score and a healthier financial future. Remember, the most important steps are to pay your bills on time, keep your credit utilization low, and regularly monitor your credit for inaccuracies or fraudulent activity.